Unlock Your Business Potential with a Business Loan No Credit: Discover Flexible Financing Options

#### Description:In today’s competitive market, securing the necessary funds to grow your business can be a daunting task, especially if you have no credit……

#### Description:

In today’s competitive market, securing the necessary funds to grow your business can be a daunting task, especially if you have no credit history. However, a **business loan no credit** could be the key to unlocking your entrepreneurial dreams. This type of financing is designed specifically for individuals and small business owners who may struggle to obtain traditional loans due to a lack of credit.

When you consider a **business loan no credit**, you open yourself up to a world of possibilities. These loans provide the necessary capital to invest in your business, whether that means purchasing new equipment, hiring additional staff, or expanding your product line. The flexibility of these loans allows you to tailor the financing to meet your unique business needs, helping you to thrive in an ever-evolving marketplace.

One of the significant advantages of a **business loan no credit** is the accessibility it offers. Many lenders understand that not all entrepreneurs have a robust credit history, and they are willing to look beyond traditional credit scores. Instead, they may evaluate your business’s cash flow, revenue, and overall potential for growth. This approach allows more business owners to qualify for funding, providing opportunities that might have otherwise been out of reach.

Additionally, obtaining a **business loan no credit** can be a strategic move for your business. By securing funding without the burden of a credit score, you can focus on what truly matters – running and growing your business. With the right financial support, you can seize market opportunities, innovate your offerings, and ultimately increase your profitability.

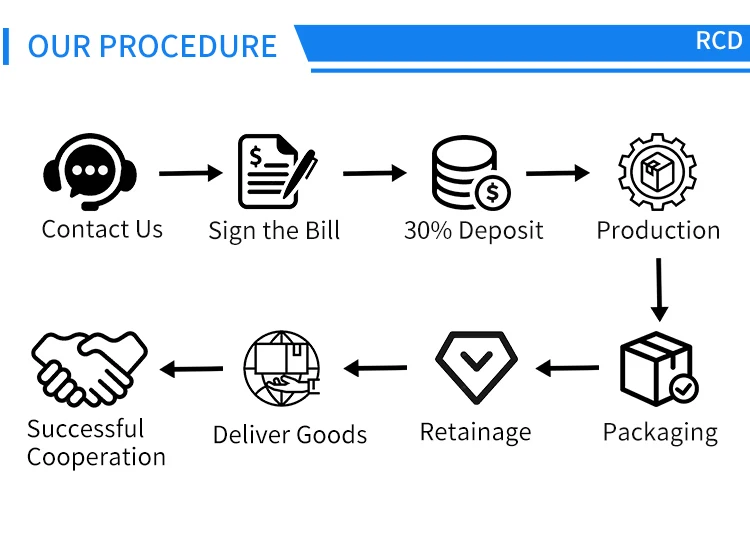

When searching for a **business loan no credit**, it’s essential to research various lenders and their offerings. Different lenders have different criteria, interest rates, and repayment terms. Some may require collateral, while others might focus on your business’s potential for success. Take the time to compare options, read reviews, and understand the terms and conditions before committing to a loan.

Moreover, applying for a **business loan no credit** is often a straightforward process. Many lenders offer online applications that can be completed in minutes, allowing you to access funds quickly. This speed is crucial for businesses that need immediate financial support to capitalize on opportunities or navigate challenges.

In conclusion, a **business loan no credit** can provide the financial boost you need to propel your business forward. By understanding your options and choosing the right lender, you can secure the funding necessary to achieve your business goals. Don’t let a lack of credit hold you back – explore the world of no credit business loans today and take the first step toward realizing your entrepreneurial vision. With determination and the right financial support, the possibilities for your business are endless.