Unlock the Best Car Loan Rates for 84 Months: Your Ultimate Guide to Affordable Financing

Guide or Summary:Understanding Car Loans: Why 84 Months?Where to Find the Best Car Loan Rates for 84 MonthsFactors Influencing Car Loan RatesTips for Securi……

Guide or Summary:

- Understanding Car Loans: Why 84 Months?

- Where to Find the Best Car Loan Rates for 84 Months

- Factors Influencing Car Loan Rates

- Tips for Securing the Best Car Loan Rates for 84 Months

Are you in the market for a new vehicle but feeling overwhelmed by financing options? Look no further! In this comprehensive guide, we will explore the best car loan rates for 84 months, helping you make informed decisions and secure the best deal possible. Whether you're eyeing a sleek sedan, a rugged SUV, or a family-friendly minivan, understanding your financing options is crucial to your car-buying experience.

Understanding Car Loans: Why 84 Months?

When it comes to financing a vehicle, the loan term is a significant factor that impacts your monthly payments and overall financial health. An 84-month loan term is becoming increasingly popular among car buyers. Why? Because it allows for lower monthly payments, making it easier to fit a new car into your budget. However, it’s essential to understand the trade-offs involved.

While spreading your payments over an extended period can provide immediate relief on your monthly budget, it may also lead to higher interest costs over the life of the loan. This is why finding the best car loan rates for 84 months is paramount. A lower interest rate can save you thousands of dollars in the long run, making your dream car more affordable.

Where to Find the Best Car Loan Rates for 84 Months

1. **Credit Unions**: Often, credit unions offer some of the most competitive rates available. If you’re a member of a credit union, check their auto loan offerings as they may have special deals for members.

2. **Online Lenders**: The digital age has brought forth a myriad of online lenders that can provide quick quotes and competitive rates. Websites like LendingTree or Bankrate allow you to compare multiple offers in one place.

3. **Dealership Financing**: Many dealerships have partnerships with banks and can offer financing options directly. While this can be convenient, always compare these rates with those from independent lenders to ensure you’re getting the best deal.

4. **Banks**: Traditional banks are still a reliable source for auto loans. Visit your bank’s website or speak with a loan officer to see what rates they currently offer for 84-month terms.

Factors Influencing Car Loan Rates

When searching for the best car loan rates for 84 months, several factors come into play:

- **Credit Score**: Your credit score is one of the most significant factors affecting your interest rate. A higher credit score typically qualifies you for lower rates. Before applying for a loan, check your credit report and take steps to improve your score if necessary.

- **Loan Amount**: The amount you wish to borrow can also affect your rate. Larger loan amounts may come with slightly higher rates, especially if they exceed the vehicle's value.

- **Vehicle Type**: New cars often have lower interest rates compared to used cars. Additionally, certain makes and models may have promotional financing rates.

- **Down Payment**: A larger down payment can reduce the amount you need to finance, potentially leading to better loan terms and lower rates.

Tips for Securing the Best Car Loan Rates for 84 Months

1. **Shop Around**: Don’t settle for the first offer you receive. Take the time to compare rates from various lenders to find the best deal.

2. **Negotiate**: Just like the price of the car, interest rates can often be negotiated. Don’t hesitate to ask for a better rate, especially if you have offers from other lenders.

3. **Consider Pre-Approval**: Getting pre-approved for a loan can give you a better idea of what rates you qualify for and can make the car-buying process smoother.

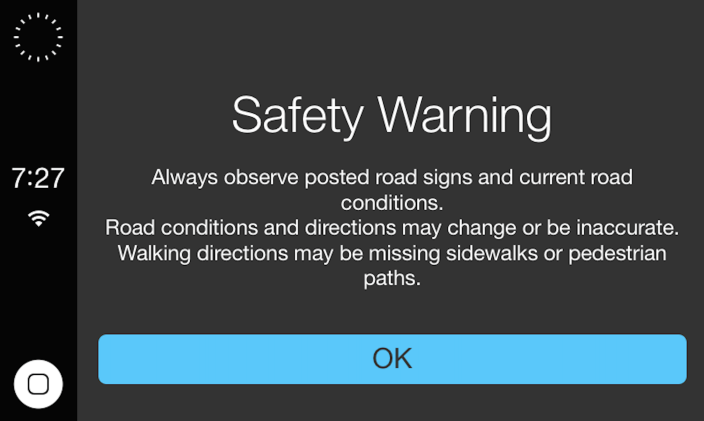

4. **Read the Fine Print**: Always review the terms of the loan carefully. Look for any hidden fees, prepayment penalties, or other conditions that could affect your financing.

In conclusion, finding the best car loan rates for 84 months can significantly impact your car-buying experience. By understanding your options and taking the time to shop around, you can secure a loan that fits your budget and lifestyle. Happy car hunting!