What is a Jumbo Loan in Florida: Your Ultimate Guide to High-Value Home Financing

When navigating the real estate market in Florida, understanding financing options is crucial, especially if you're eyeing a high-value property. What is a……

When navigating the real estate market in Florida, understanding financing options is crucial, especially if you're eyeing a high-value property. What is a jumbo loan in Florida? This is a question many prospective homeowners ask, and for good reason. Jumbo loans are a vital tool for those looking to purchase luxury homes or properties in high-cost areas where conventional loan limits fall short.

### What is a Jumbo Loan?

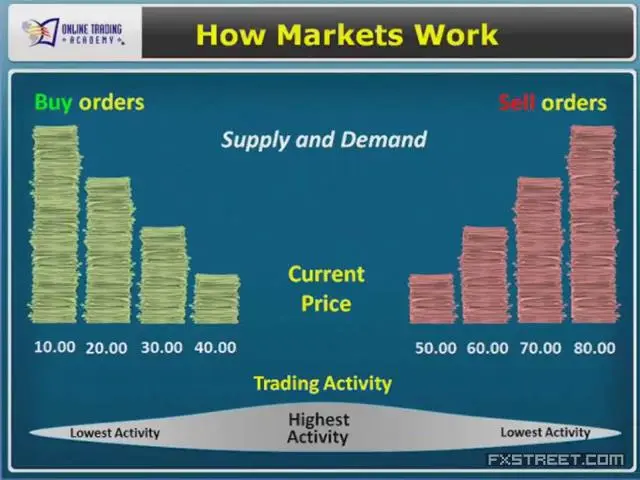

A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). In 2023, the conforming loan limit in most areas of the U.S. is $726,200, but in high-cost areas like parts of Florida, this limit can be higher. For example, in certain counties, the limit may be as high as $1,000,000 or more. Therefore, if you're considering purchasing a home in a desirable Florida location and the price exceeds these limits, a jumbo loan may be your best option.

### Key Features of Jumbo Loans

1. **Higher Loan Amounts**: As the name implies, jumbo loans are designed for larger loan amounts. This makes them ideal for purchasing luxury homes, waterfront properties, or spacious estates in Florida's competitive real estate market.

2. **Strict Credit Requirements**: Lenders typically impose stricter credit requirements for jumbo loans. Borrowers usually need a credit score of at least 700, and some lenders may even require a score of 740 or higher. This ensures that the borrower has a solid financial background.

3. **Higher Down Payments**: Unlike conventional loans, which may allow for down payments as low as 3%, jumbo loans often require a minimum down payment of 10% to 20%. This is particularly important to consider when budgeting for your new home.

4. **Interest Rates**: Although jumbo loans often have slightly higher interest rates compared to conventional loans, the difference can be minimal, especially in a low-rate environment. It’s essential to shop around and compare rates from different lenders.

5. **No Private Mortgage Insurance (PMI)**: While conventional loans typically require PMI when the down payment is less than 20%, most jumbo loans do not require this insurance, which can save you money in the long run.

### Benefits of Jumbo Loans in Florida

- **Access to Luxury Properties**: Florida is home to some of the most luxurious real estate in the country. With a jumbo loan, you can broaden your search and target properties that meet your lifestyle needs.

- **Flexible Terms**: Many lenders offer flexible terms for jumbo loans, including adjustable-rate mortgages (ARMs) and fixed-rate options, allowing you to choose a plan that fits your financial situation.

- **Potential for Refinancing**: If property values increase, you may have the opportunity to refinance your jumbo loan into a lower rate, which can lead to significant savings over time.

### Conclusion

Understanding what is a jumbo loan in Florida is essential for anyone looking to invest in high-value real estate in the Sunshine State. With the right knowledge and preparation, you can leverage jumbo loans to secure your dream home. Whether you're drawn to the vibrant culture of Miami, the serene beaches of Naples, or the bustling life in Orlando, a jumbo loan can help you make that dream a reality. Always consult with a mortgage professional to ensure you understand all the details and find the best option for your financial situation.