Unlock Your Dream Ride: How to Secure the Best Finance Auto Loan for Your Next Vehicle

Guide or Summary:Introduction to Finance Auto LoanWhat is a Finance Auto Loan?Types of Finance Auto LoansHow to Choose the Right Finance Auto LoanUnderstand……

Guide or Summary:

- Introduction to Finance Auto Loan

- What is a Finance Auto Loan?

- Types of Finance Auto Loans

- How to Choose the Right Finance Auto Loan

- Understanding Interest Rates and Terms

- The Application Process

- Tips for Securing the Best Finance Auto Loan

---

Introduction to Finance Auto Loan

In today's fast-paced world, owning a vehicle is more than just a convenience; it's a necessity. However, purchasing a car can be a significant financial commitment. This is where a finance auto loan comes into play. By understanding the intricacies of finance auto loans, you can make informed decisions that will lead you to your dream vehicle without breaking the bank.

What is a Finance Auto Loan?

A finance auto loan is a type of loan specifically designed for purchasing vehicles. When you take out this loan, the lender provides you with the funds needed to buy a car, and you agree to pay back the loan amount, plus interest, over a specified period. This arrangement allows you to drive your new car immediately while spreading the cost over time, making it more manageable for your budget.

Types of Finance Auto Loans

There are generally two types of finance auto loans: secured and unsecured. A secured loan is backed by the vehicle itself, meaning if you fail to make payments, the lender can repossess the car. Unsecured loans, on the other hand, do not require collateral but typically come with higher interest rates. Understanding the differences can help you choose the right option for your financial situation.

How to Choose the Right Finance Auto Loan

Choosing the right finance auto loan involves several factors. First, assess your credit score, as it significantly influences the interest rates offered. A higher credit score often leads to lower interest rates, which can save you a substantial amount over the life of the loan.

Next, shop around for the best rates. Different lenders offer various terms and conditions, so it’s essential to compare offers from banks, credit unions, and online lenders. Look for loans with no hidden fees and favorable repayment terms.

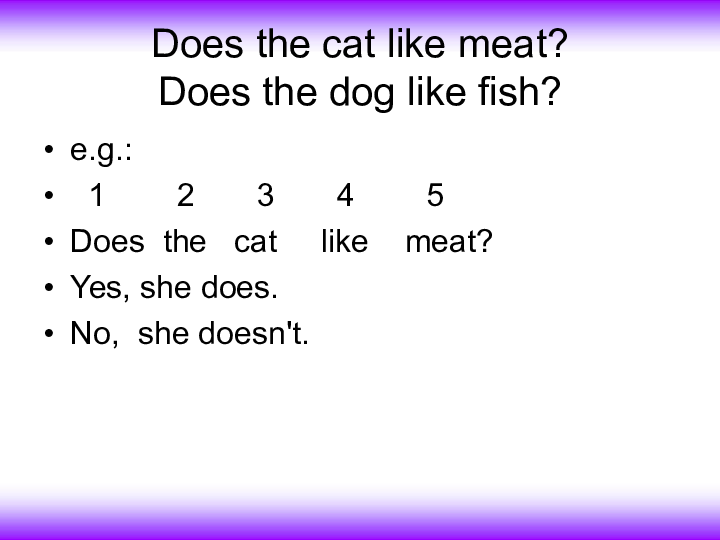

Understanding Interest Rates and Terms

Interest rates on finance auto loans can vary widely based on your credit score, the lender, and the loan term. Typically, shorter loan terms come with lower interest rates but higher monthly payments. Conversely, longer terms may offer lower monthly payments but could result in paying more in interest over time. Finding the right balance is crucial for your financial health.

The Application Process

Applying for a finance auto loan is a straightforward process. Start by gathering necessary documents, including proof of income, identification, and details about the vehicle you wish to purchase. Many lenders offer pre-approval, which gives you an idea of how much you can borrow and at what interest rate. This step can make the car-buying process much smoother.

Tips for Securing the Best Finance Auto Loan

1. **Improve Your Credit Score**: Before applying, take steps to enhance your credit score, such as paying off debts and correcting any errors on your credit report.

2. **Consider a Larger Down Payment**: A larger down payment reduces the amount you need to borrow, which can lead to better loan terms and lower monthly payments.

3. **Negotiate the Terms**: Don’t hesitate to negotiate with lenders. Sometimes, they may be willing to offer better rates or terms to secure your business.

4. **Read the Fine Print**: Always review the loan agreement carefully. Look for any fees, penalties, or conditions that could affect your repayment.

Securing a finance auto loan can be a gateway to owning the vehicle you've always desired. By understanding the types of loans available, evaluating your financial situation, and following the tips outlined above, you can navigate the loan process with confidence. Remember, the goal is to find a loan that not only fits your budget but also aligns with your long-term financial goals. With the right finance auto loan, you'll be hitting the road in your dream car in no time!