Understanding Loan Sharking Meaning: What You Need to Know About Illegal Lending Practices

Guide or Summary:Understanding Loan Sharking Meaning: What You Need to Know About Illegal Lending PracticesUnderstanding Loan Sharking Meaning: What You Nee……

Guide or Summary:

Understanding Loan Sharking Meaning: What You Need to Know About Illegal Lending Practices

Loan sharking is a term that evokes a strong reaction, often associated with predatory lending practices that exploit vulnerable individuals desperate for quick cash. Understanding the meaning of loan sharking is essential in today's financial landscape, where many individuals may find themselves in dire need of funds but are unaware of the potential dangers lurking in the shadows of the lending world.

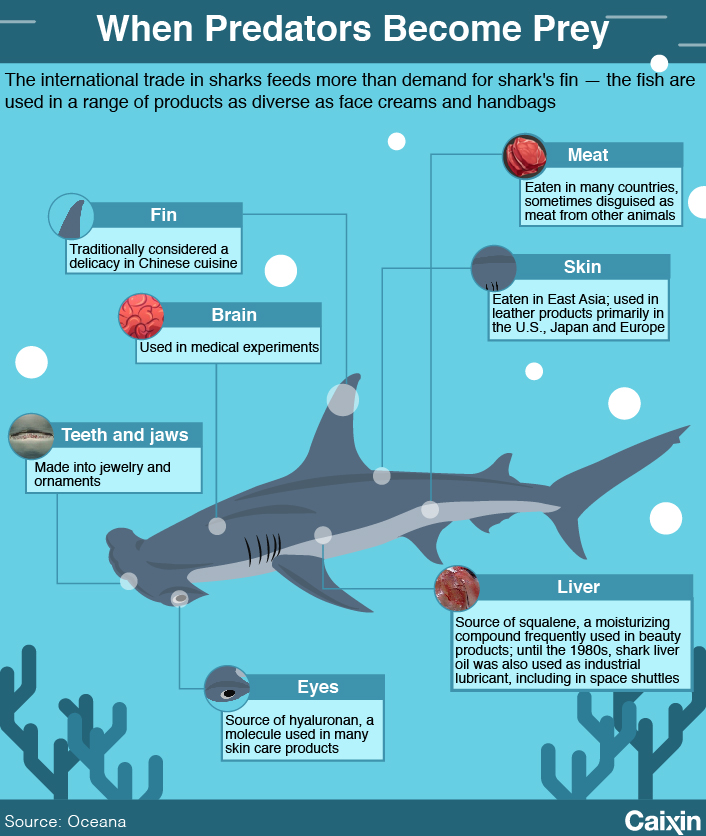

At its core, loan sharking refers to the illegal practice of lending money at extremely high-interest rates, often without the necessary licenses or regulatory oversight. These lenders, commonly known as "loan sharks," typically target individuals who may have poor credit histories or those who are unable to secure loans from traditional financial institutions. The desperation of borrowers makes them easy targets for these unscrupulous lenders, who often employ aggressive tactics to ensure repayment.

The meaning of loan sharking extends beyond just high-interest rates; it encompasses a range of unethical and often illegal practices. Loan sharks may charge exorbitant fees, impose harsh penalties for late payments, and use intimidation or threats to collect debts. This creates a cycle of debt that is nearly impossible for borrowers to escape, leading to severe financial and emotional distress.

One of the most troubling aspects of loan sharking is the lack of transparency. Unlike legitimate lenders, loan sharks often operate in secrecy, making it difficult for borrowers to understand the true cost of their loans. They may not provide clear information about interest rates, repayment terms, or the total amount owed, leaving borrowers vulnerable to exploitation. This lack of transparency is a hallmark of loan sharking, as it allows these lenders to manipulate borrowers into unfavorable agreements.

The consequences of falling victim to loan sharking can be devastating. Many individuals who take out loans from these predatory lenders find themselves trapped in a cycle of debt that can lead to bankruptcy, loss of assets, and even legal troubles. The stress and anxiety associated with dealing with loan sharks can also take a toll on mental health, leading to feelings of hopelessness and despair.

Recognizing the signs of loan sharking is crucial for anyone seeking financial assistance. Some warning signs include lenders who do not require a credit check, those who offer cash with little to no paperwork, and lenders who pressure borrowers to act quickly. Additionally, if a lender uses aggressive or threatening tactics to collect debts, it is a clear indication that they may be operating outside the law.

If you or someone you know is struggling with loan sharking, it is important to seek help. There are resources available for individuals facing financial difficulties, including credit counseling services and legal aid organizations. These resources can provide guidance on how to navigate the challenges posed by loan sharks and help individuals regain control of their financial situations.

In conclusion, understanding the meaning of loan sharking is vital in protecting oneself from the dangers of illegal lending practices. By educating yourself about the characteristics of loan sharks and recognizing the signs of predatory lending, you can make informed decisions about your financial future. Remember, if you find yourself in need of financial assistance, it is always best to explore legitimate options before resorting to high-risk loans from unregulated lenders. Your financial well-being is worth the effort to seek out safe and responsible lending practices.