** Unlock Your Financial Freedom with PayPal Loan Personal: A Comprehensive Guide

### DescriptionIn today's fast-paced world, financial flexibility is essential for managing unexpected expenses and achieving personal goals. One solution t……

### Description

In today's fast-paced world, financial flexibility is essential for managing unexpected expenses and achieving personal goals. One solution that has gained traction is the PayPal Loan Personal, a financial service designed to help individuals secure the funds they need quickly and efficiently. This guide aims to provide you with a comprehensive understanding of the PayPal Loan Personal, its benefits, eligibility criteria, application process, and how it can help you achieve your financial objectives.

#### Understanding PayPal Loan Personal

The PayPal Loan Personal offers a convenient way for users of PayPal to access personal loans without the hassle of traditional banking procedures. With the rise of digital financial services, PayPal has expanded its offerings to include personal loans, allowing users to borrow money directly through their PayPal accounts. This service is particularly appealing to those who may not have access to conventional credit options or who prefer the simplicity of managing their finances online.

#### Benefits of PayPal Loan Personal

One of the most significant advantages of the PayPal Loan Personal is the speed at which funds can be accessed. Unlike traditional loans that can take days or even weeks to process, PayPal's personal loan service often provides funds within a matter of hours. This rapid turnaround is invaluable for individuals facing emergencies or time-sensitive financial needs.

Another benefit is the user-friendly application process. Customers can apply for a loan directly through their PayPal account, making it easy to manage their finances in one place. The digital application is straightforward, requiring minimal documentation, which can save borrowers time and stress.

Additionally, the PayPal Loan Personal offers competitive interest rates compared to many credit cards and other forms of unsecured loans. This affordability can make a significant difference for borrowers who are looking to consolidate debt or finance a large purchase without incurring high interest costs.

#### Eligibility Criteria

To qualify for a PayPal Loan Personal, applicants must meet certain eligibility requirements. Typically, these include being a PayPal account holder in good standing, having a consistent source of income, and meeting a minimum credit score threshold. PayPal may also consider other factors, such as the applicant's transaction history and overall financial behavior, when determining eligibility.

It's important to note that while the application process is streamlined, borrowers should still prepare to provide some personal and financial information. This may include details about employment, income, and any existing debts. Being transparent and providing accurate information can help facilitate a smoother approval process.

#### The Application Process

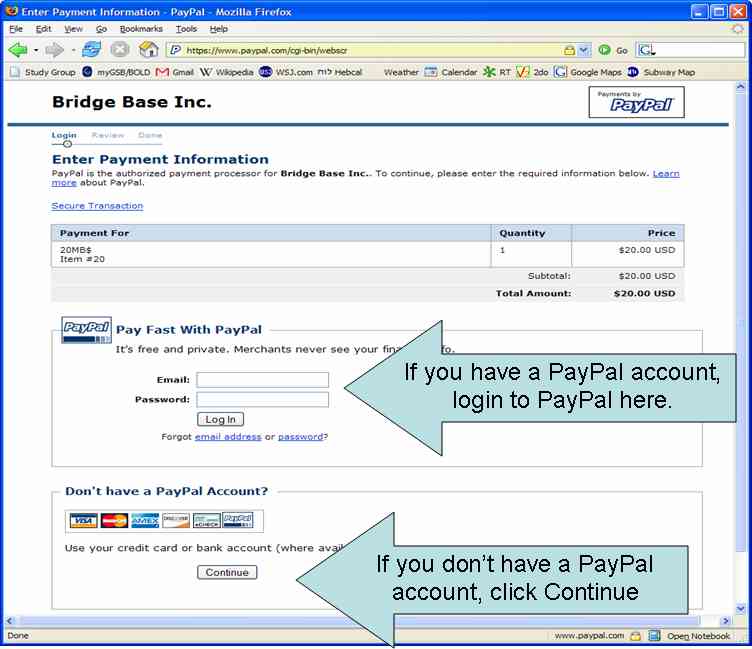

Applying for a PayPal Loan Personal is designed to be as seamless as possible. Once you log into your PayPal account, you can navigate to the loan section and fill out the application form. The system will prompt you for the necessary information, guiding you through each step.

After submitting your application, PayPal will review your information and make a decision quickly. If approved, you can expect to receive funds directly into your PayPal account, making it easy to access your money and use it as needed.

#### Using Your PayPal Loan Personal Wisely

Once you've secured a PayPal Loan Personal, it's crucial to use the funds wisely. Consider your financial goals and how the loan can help you achieve them. Whether it's consolidating debt, covering emergency expenses, or making a significant purchase, having a clear plan will help you manage your repayment effectively.

Additionally, be mindful of the repayment terms associated with your loan. Understanding the interest rates, due dates, and any potential fees will help you avoid surprises down the line. Setting up automatic payments through your PayPal account can also ensure that you stay on track with your repayments.

#### Conclusion

In summary, the PayPal Loan Personal is an excellent option for individuals seeking quick and convenient access to personal loans. With its user-friendly application process, competitive interest rates, and rapid funding, it provides a viable alternative to traditional lending methods. By understanding the benefits, eligibility criteria, and responsible usage of these loans, you can make informed financial decisions that align with your goals. Whether you're facing an unexpected expense or planning for a future investment, the PayPal Loan Personal can be a valuable tool in your financial toolkit.