Understanding Home Equity Loan Loan to Value: A Comprehensive Guide for Homeowners

#### What is Home Equity Loan Loan to Value?Home equity loan loan to value (LTV) is a crucial concept for homeowners looking to leverage their property’s eq……

#### What is Home Equity Loan Loan to Value?

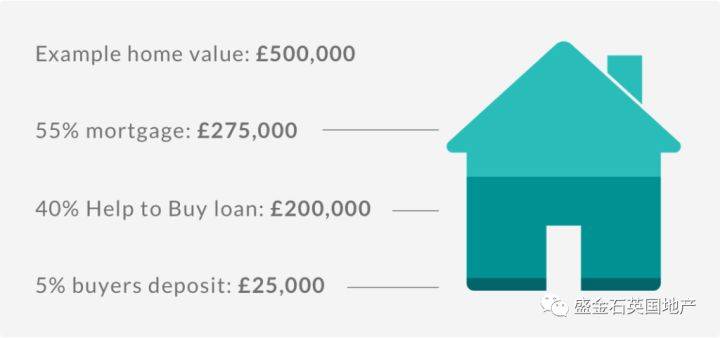

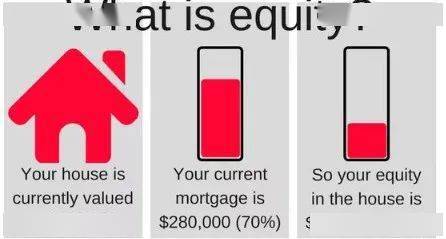

Home equity loan loan to value (LTV) is a crucial concept for homeowners looking to leverage their property’s equity. LTV is a financial term that represents the ratio of a loan to the value of an asset purchased. In the context of home equity loans, it indicates how much of the home’s value is borrowed against. For instance, if your home is valued at $300,000 and you have a $150,000 home equity loan, your LTV would be 50%. This metric is vital for lenders as it helps them assess the risk associated with the loan.

#### Why is Home Equity Loan Loan to Value Important?

Understanding home equity loan loan to value is essential for several reasons. First, it plays a significant role in determining the interest rates on your loan. Generally, a lower LTV ratio indicates less risk for the lender, which can result in lower interest rates for the borrower. Conversely, a higher LTV ratio may lead to higher rates, as lenders perceive more risk.

Additionally, LTV is a key factor in the approval process for home equity loans. Most lenders have maximum LTV limits, often capping them at 80% to 90%. This means that if your LTV exceeds this limit, you may not qualify for the loan or may need to pay for private mortgage insurance (PMI), which can add to your monthly payments.

#### How to Calculate Home Equity Loan Loan to Value?

Calculating your home equity loan loan to value is straightforward. Follow these steps:

1. **Determine Your Home’s Current Market Value**: This can be done through a professional appraisal or by researching comparable home sales in your area.

2. **Calculate Your Total Mortgage Debt**: Add up all existing mortgages and any home equity loans you currently have.

3. **Use the LTV Formula**: The formula for calculating LTV is:

\[

LTV = \frac{Total Mortgage Debt}{Current Home Value} \times 100

\]

For example, if your home is valued at $250,000 and you owe $175,000, your LTV would be:

LTV = \frac{175,000}{250,000} \times 100 = 70\%

#### Strategies to Improve Home Equity Loan Loan to Value

If your LTV is on the higher side, there are several strategies you can employ to improve it:

1. **Increase Your Home’s Value**: Consider renovations or improvements that can boost your home’s market value. Upgrades like kitchen remodels or adding energy-efficient features can yield a good return on investment.

2. **Pay Down Your Mortgage**: Making extra payments toward your mortgage can reduce your outstanding balance, thereby improving your LTV.

3. **Refinance Your Loan**: If interest rates drop, refinancing your existing mortgage may lower your monthly payments and help you build equity faster.

4. **Wait for Market Appreciation**: Real estate markets can fluctuate. If you can afford to wait, a rising market may increase your home’s value, thereby improving your LTV.

#### Final Thoughts on Home Equity Loan Loan to Value

In conclusion, understanding home equity loan loan to value is vital for any homeowner considering tapping into their home’s equity. Not only does it affect your eligibility for loans and interest rates, but it also influences your overall financial health. By keeping an eye on your LTV and employing strategies to improve it, you can make informed decisions that benefit your financial future. Whether you’re looking to fund home improvements, consolidate debt, or cover unexpected expenses, knowing how LTV works can empower you to make the best choice for your situation.