Effective Strategies on How to Get Lower Student Loan Payments

Guide or Summary:Understanding Student LoansAssessing Your Financial SituationExploring Repayment PlansLoan Forgiveness ProgramsRefinancing Your LoansConsid……

Guide or Summary:

- Understanding Student Loans

- Assessing Your Financial Situation

- Exploring Repayment Plans

- Loan Forgiveness Programs

- Refinancing Your Loans

- Consider Temporary Relief Options

- Budgeting for Student Loan Payments

- Seeking Financial Advice

#### Translation: 如何降低学生贷款还款额

---

Understanding Student Loans

Student loans are a significant financial burden for many graduates. With the rising cost of education, students often find themselves in debt that can take years, if not decades, to repay. Understanding the types of student loans available, such as federal and private loans, is crucial to navigating repayment options. Federal loans often come with more flexible repayment plans compared to private loans, which may have stricter terms and higher interest rates.

Assessing Your Financial Situation

Before seeking ways to lower your student loan payments, it's essential to assess your current financial situation. Create a budget that outlines your income, expenses, and any other debts you may have. This will give you a clearer picture of how much you can afford to pay towards your student loans each month. Knowing your financial limitations will help you choose the best repayment option.

Exploring Repayment Plans

One of the most effective ways to lower your student loan payments is by exploring different repayment plans. Federal student loans offer several repayment options, including:

1. **Standard Repayment Plan**: Fixed payments over ten years.

2. **Graduated Repayment Plan**: Lower payments that increase every two years.

3. **Extended Repayment Plan**: Extended payments over 25 years, which can lower your monthly payment but increase total interest paid.

4. **Income-Driven Repayment Plans**: Payments based on your income and family size, which can significantly reduce monthly payments.

Loan Forgiveness Programs

Another avenue to explore is loan forgiveness programs. Federal student loans may qualify for forgiveness after a certain period of qualifying payments. Programs such as Public Service Loan Forgiveness (PSLF) are designed for those working in public service jobs. If you meet the criteria, you could have the remaining balance of your loan forgiven after making 120 qualifying payments.

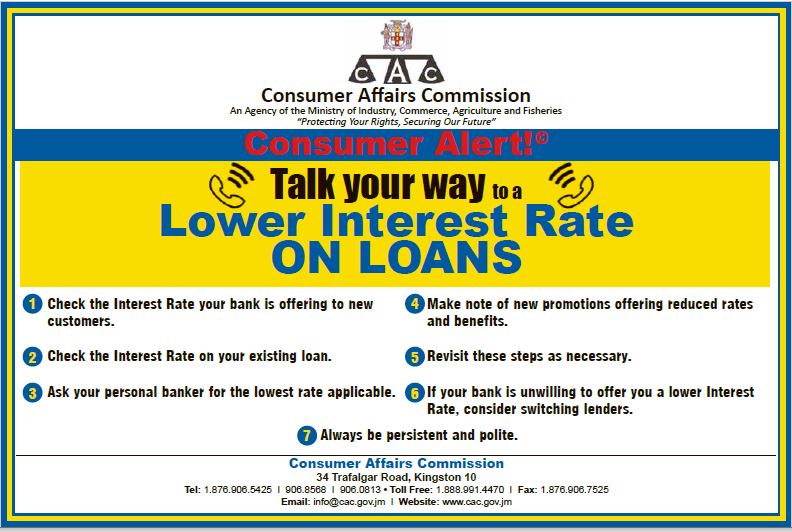

Refinancing Your Loans

If you have private student loans, refinancing might be an option to consider. By refinancing, you can potentially secure a lower interest rate, which can lower your monthly payments. However, it's essential to weigh the pros and cons, as refinancing federal loans into private loans means losing federal protections and repayment options.

Consider Temporary Relief Options

In times of financial hardship, temporary relief options may be available. For instance, you might qualify for a deferment or forbearance, which allows you to temporarily pause or reduce your payments. However, interest may continue to accrue during this period, so it's crucial to understand the long-term implications.

Budgeting for Student Loan Payments

Effective budgeting can also play a significant role in managing student loan payments. Allocate a specific portion of your income to your loans and prioritize them in your budget. Look for areas where you can cut back on spending, such as dining out or subscription services, to free up more money for your loan payments.

Seeking Financial Advice

If you're feeling overwhelmed, consider seeking advice from a financial advisor or a student loan counselor. They can provide personalized guidance based on your unique situation and help you navigate the complexities of student loan repayment.

In conclusion, knowing how to get lower student loan payments involves a combination of understanding your loans, exploring repayment options, and effectively managing your finances. By taking proactive steps and utilizing available resources, you can alleviate the burden of student loan debt and work towards financial stability. Whether it's through income-driven repayment plans, loan forgiveness programs, or refinancing, there are numerous strategies available to help you achieve lower monthly payments and a brighter financial future.