What is the Federal Student Loan Interest Rate: A Comprehensive Guide

Guide or Summary:Understanding Federal Student Loan Interest RatesFixed Interest RatesVariable Interest RatesFactors Influencing Federal Student Loan Intere……

Guide or Summary:

- Understanding Federal Student Loan Interest Rates

- Fixed Interest Rates

- Variable Interest Rates

- Factors Influencing Federal Student Loan Interest Rates

- Impact on Your Education Investment

- Navigating the Complexities of Federal Student Loans

In the ever-evolving landscape of higher education, understanding the federal student loan interest rate is crucial for both prospective students and current borrowers. This comprehensive guide delves into the nuances of federal student loan interest rates, their impact on your education investment, and how to navigate the complexities of federal student loans.

Understanding Federal Student Loan Interest Rates

Federal student loans are offered by the U.S. Department of Education and are designed to make higher education more accessible to all Americans. These loans come with fixed and variable interest rates, depending on the type of loan and the borrower's eligibility.

Fixed Interest Rates

Federal Direct Subsidized Loans and Federal Direct Unsubsidized Loans offer fixed interest rates. As of the latest update, the federal student loan interest rate for Direct Subsidized Loans is 4.53% for undergraduate borrowers and 5.84% for graduate borrowers. For Direct Unsubsidized Loans, the rates are 4.53% for undergraduate borrowers and 5.84% for graduate borrowers. These rates are set by law and remain constant throughout the life of the loan.

Variable Interest Rates

Federal Direct PLUS Loans, designed for parents of undergraduate students, feature variable interest rates. The current interest rate for Federal Direct PLUS Loans is 7.09% for undergraduate borrowers and 7.09% for graduate borrowers. These rates are subject to change annually based on market conditions and are adjusted on July 1st each year.

Factors Influencing Federal Student Loan Interest Rates

Several factors influence federal student loan interest rates, including the borrower's creditworthiness, the type of loan, and the borrower's income level. For instance, borrowers with good credit scores may qualify for lower interest rates on Direct PLUS Loans, while income-driven repayment plans can lower monthly payments for borrowers with higher incomes.

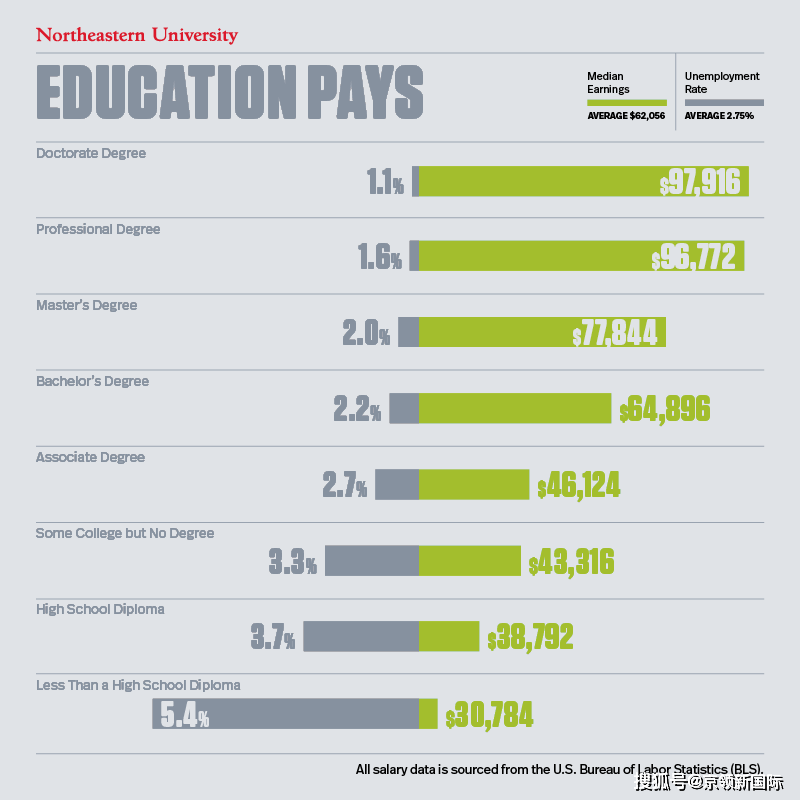

Impact on Your Education Investment

Understanding the federal student loan interest rate is essential for making informed decisions about your education investment. Higher interest rates can significantly impact the total amount you'll pay over the life of your loan, making it crucial to explore all available repayment options and loan forgiveness programs.

Navigating the Complexities of Federal Student Loans

Navigating the complexities of federal student loans can be challenging, but staying informed is key to making the most of your educational opportunities. Familiarize yourself with the various loan types, interest rates, and repayment options available to you. Additionally, consider speaking with a financial advisor or attending workshops offered by your school's financial aid office to gain a better understanding of your options.

In conclusion, understanding the federal student loan interest rate is essential for making informed decisions about your higher education investment. By exploring the various loan types, interest rates, and repayment options available to you, you can navigate the complexities of federal student loans and make the most of your educational opportunities. Remember, knowledge is power, and with the right information, you can secure a brighter future for yourself and your family.