Understanding Student Loan Options for International Students: A Comprehensive Guide to Financing Your Education

#### Student LoanStudent loans are a critical financial resource for many students pursuing higher education. These loans are typically offered by governmen……

#### Student Loan

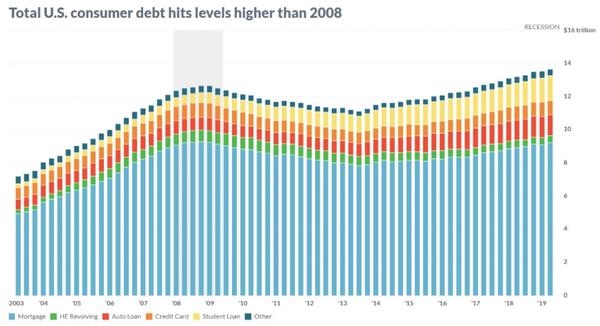

Student loans are a critical financial resource for many students pursuing higher education. These loans are typically offered by government entities or private institutions to help cover the costs of tuition, fees, books, and living expenses. For international students, navigating the world of student loans can be particularly challenging due to varying regulations, eligibility requirements, and repayment options across different countries.

#### International Student

An international student is someone who chooses to study in a country other than their own. This experience often enriches their education and cultural understanding but can also present unique financial challenges. International students may face higher tuition rates and limited access to financial aid compared to domestic students. Understanding the specific student loan options available to them is crucial for managing their finances effectively.

#### Student Loan International Student

For international students, securing a student loan can be a daunting task. Many traditional lenders may require a co-signer who is a citizen or permanent resident of the country where the student is studying. Additionally, international students may not have a credit history in the host country, which can further complicate their ability to obtain loans. However, there are specialized lenders and programs designed specifically for international students that can help bridge this gap.

One of the first steps for international students seeking a student loan is to research the loan options available in their host country. In the United States, for example, there are private lenders that cater to international students, offering loans without the need for a co-signer. These loans typically come with higher interest rates and may require proof of income or a strong academic record.

In the United Kingdom, international students can access loans through specific programs, such as the UK government’s Student Finance system, although eligibility may vary. Similarly, other countries have their own regulations and options for student loans that international students should explore.

#### Repayment Options

Repayment of student loans is another critical aspect that international students must consider. Many loans offer a grace period after graduation, during which students are not required to make payments. However, understanding the terms and conditions of repayment is essential to avoid defaulting on loans. Some lenders may offer flexible repayment plans based on the borrower’s income, which can be particularly beneficial for international students who may face challenges in securing employment immediately after graduation.

#### Conclusion

In conclusion, while the process of obtaining a student loan as an international student can be complex, it is not insurmountable. By researching the various options available, understanding the requirements, and planning for repayment, international students can successfully navigate the financial landscape of studying abroad. It is advisable for students to seek guidance from their educational institutions, financial advisors, or student loan counselors who specialize in international education finance. By taking proactive steps, international students can secure the funding they need to achieve their academic goals and make the most of their educational experience abroad.