"Unlocking Homeownership: The Benefits of a 1 Down Mortgage Loan for First-Time Buyers"

#### Understanding the 1 Down Mortgage LoanA **1 down mortgage loan** is an innovative financing option that allows potential homeowners to purchase a prope……

#### Understanding the 1 Down Mortgage Loan

A **1 down mortgage loan** is an innovative financing option that allows potential homeowners to purchase a property with a minimal down payment of just 1%. This type of loan is particularly appealing to first-time buyers who may struggle to save for a traditional down payment, which often ranges from 3% to 20%. The 1 down mortgage loan opens the door to homeownership for many individuals and families who might otherwise be priced out of the market.

#### Why Choose a 1 Down Mortgage Loan?

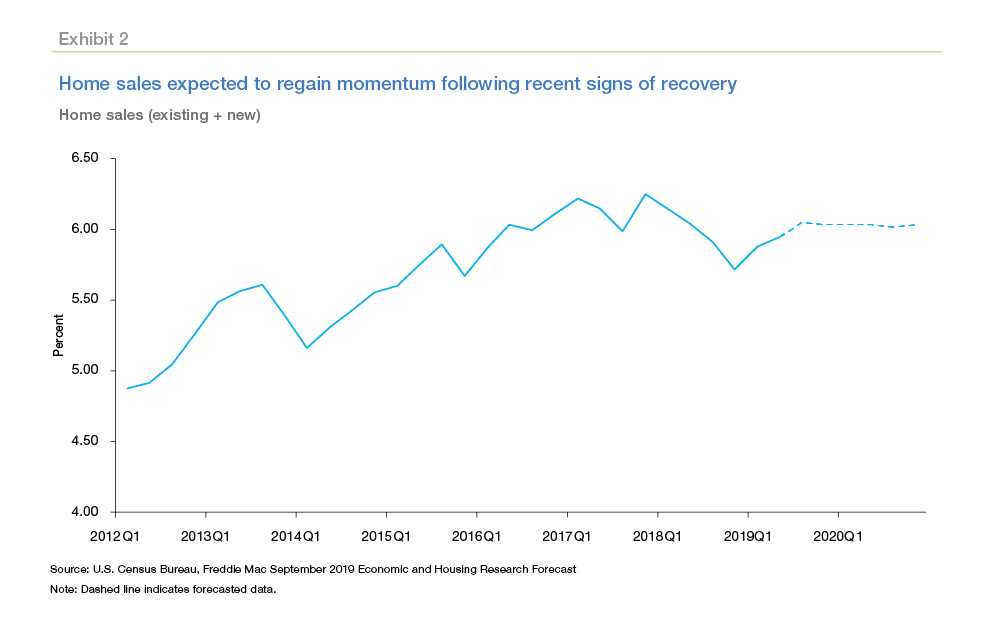

One of the most significant advantages of a **1 down mortgage loan** is the reduced financial barrier to entry. With housing prices on the rise in many areas, saving for a large down payment can be a daunting task. By lowering the down payment requirement, this loan option enables buyers to enter the housing market sooner rather than later.

Additionally, a lower down payment means that buyers can allocate their savings towards other important expenses, such as moving costs, home improvements, or emergency funds. This flexibility is crucial for first-time buyers who may not have extensive financial resources.

#### Eligibility Criteria for a 1 Down Mortgage Loan

While the **1 down mortgage loan** is designed to help first-time buyers, there are specific eligibility criteria that applicants must meet. Lenders typically look for a stable income, a good credit score, and a manageable debt-to-income ratio. It's essential for potential borrowers to prepare their financial documentation and understand their credit standing before applying.

Some programs may also require buyers to complete a homebuyer education course to ensure they are well-informed about the responsibilities of homeownership. This education can be invaluable, as it equips buyers with the knowledge they need to manage their mortgage and maintain their new home effectively.

#### Comparing 1 Down Mortgage Loans to Traditional Loans

When considering a **1 down mortgage loan**, it's important to compare it with traditional mortgage options. Traditional loans often require higher down payments, which can significantly impact monthly payments and overall affordability. While a lower down payment can lead to a higher loan amount and potentially higher monthly payments, the trade-off is often worth it for those eager to secure a home.

Moreover, some lenders may offer competitive interest rates on 1 down mortgage loans, making them an attractive option for buyers. It's crucial to shop around and compare offers from different lenders to find the best terms available.

#### Potential Drawbacks of a 1 Down Mortgage Loan

Despite the benefits, there are potential drawbacks to consider with a **1 down mortgage loan**. One of the main concerns is that a lower down payment can lead to higher monthly payments and increased interest over the life of the loan. Additionally, borrowers may be required to pay for private mortgage insurance (PMI), which can further increase monthly costs.

It's also important for buyers to assess their long-term financial stability. A lower down payment can be enticing, but it's essential to ensure that you can comfortably afford the ongoing costs of homeownership, including maintenance, property taxes, and insurance.

#### Conclusion: Is a 1 Down Mortgage Loan Right for You?

In conclusion, a **1 down mortgage loan** can be an excellent option for first-time homebuyers looking to enter the housing market with minimal upfront costs. By understanding the benefits, eligibility criteria, and potential drawbacks, buyers can make informed decisions about their home financing options.

If you're considering homeownership but are concerned about the challenges of saving for a substantial down payment, exploring a 1 down mortgage loan could be the first step toward achieving your dream of owning a home. Always consult with a financial advisor or mortgage specialist to determine the best path for your unique situation.