Understanding Direct Lenders Loans: A Comprehensive Guide to Fast and Reliable Financing

#### What are Direct Lenders Loans?Direct lenders loans refer to financial products offered by lenders who provide funds directly to borrowers without inter……

#### What are Direct Lenders Loans?

Direct lenders loans refer to financial products offered by lenders who provide funds directly to borrowers without intermediaries or brokers. This type of lending allows borrowers to receive funds quickly and efficiently, as the process is streamlined and often requires less paperwork compared to traditional lending methods. Direct lenders can include banks, credit unions, and online financial institutions that specialize in various types of loans, such as personal loans, auto loans, or mortgages.

#### The Advantages of Direct Lenders Loans

One of the primary benefits of choosing direct lenders loans is the speed of the application and approval process. Borrowers can often receive funds within a short timeframe, sometimes as quickly as the same day. This is particularly advantageous for individuals facing emergencies or unexpected expenses.

Another advantage is the potential for better interest rates and terms. Since direct lenders operate without intermediaries, they may offer more competitive rates than traditional lenders. Additionally, borrowers can often negotiate terms directly with the lender, leading to a more personalized borrowing experience.

#### How to Apply for Direct Lenders Loans

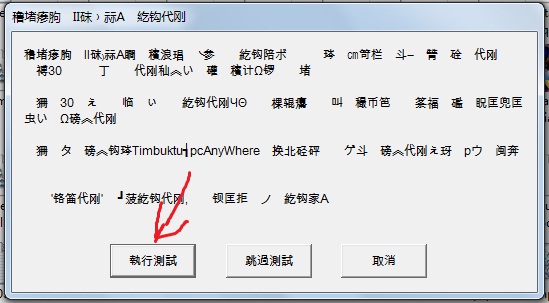

Applying for direct lenders loans typically involves a straightforward process. Borrowers can start by researching different lenders to find one that meets their needs. It’s important to compare interest rates, loan terms, and eligibility requirements. Most direct lenders have online platforms that allow for easy application submissions.

Once a lender is chosen, the borrower will need to provide personal information, including income details, credit history, and the purpose of the loan. After submitting the application, the lender will review the information and make a decision. If approved, the borrower will receive the loan agreement outlining the terms and conditions before the funds are disbursed.

#### Considerations Before Choosing Direct Lenders Loans

While direct lenders loans offer many benefits, borrowers should also consider a few important factors before proceeding. First, it’s essential to check the lender’s reputation. Reading customer reviews and ratings can provide insights into the lender's reliability and customer service.

Additionally, borrowers should be aware of any fees associated with the loan, such as origination fees or prepayment penalties. Understanding the total cost of the loan is crucial to avoid any unexpected financial burdens.

Finally, borrowers should assess their own financial situation and repayment ability. Taking on debt should be a well-considered decision, and borrowers should ensure they can meet the repayment terms without compromising their financial stability.

#### Conclusion

In summary, direct lenders loans can be an excellent option for those in need of fast and reliable financing. With a straightforward application process, competitive rates, and the ability to negotiate terms directly, borrowers can benefit significantly from this lending approach. However, it’s essential to conduct thorough research and consider all factors before committing to a loan. By doing so, borrowers can make informed decisions that align with their financial goals and needs.