Do Chase Bank Do Loans? Exploring the Loan Options Offered by Chase Bank

Guide or Summary:Introduction to Chase Bank LoansTypes of Loans Offered by Chase BankEligibility and Application ProcessBenefits of Choosing Chase Bank for……

Guide or Summary:

- Introduction to Chase Bank Loans

- Types of Loans Offered by Chase Bank

- Eligibility and Application Process

- Benefits of Choosing Chase Bank for Loans

**Translation of "do chase bank do loans":** Do Chase Bank Do Loans?

Introduction to Chase Bank Loans

When considering financial institutions for loans, many potential borrowers ask, "Do Chase Bank do loans?" The answer is a resounding yes. Chase Bank, one of the largest banks in the United States, offers a variety of loan products to meet the needs of its customers. From personal loans to mortgages and auto loans, Chase provides a comprehensive suite of options for individuals looking to finance their dreams.

Types of Loans Offered by Chase Bank

Chase Bank provides several types of loans, each designed for different financial needs:

1. **Personal Loans**: Chase offers personal loans that can be used for various purposes, including debt consolidation, home improvements, or unexpected expenses. These loans typically come with fixed interest rates and flexible repayment terms.

2. **Mortgage Loans**: For those looking to purchase a home, Chase Bank has a range of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and FHA loans. They also offer refinancing options for existing homeowners who wish to lower their monthly payments or tap into their home equity.

3. **Auto Loans**: Chase provides auto loans for new and used vehicles, making it easier for customers to finance their next car purchase. With competitive rates and flexible terms, borrowers can find a loan that fits their budget.

4. **Business Loans**: Chase also extends its lending services to small businesses with options like business lines of credit, term loans, and commercial real estate loans. This support helps entrepreneurs access the capital they need to grow their businesses.

Eligibility and Application Process

To answer the question, "Do Chase Bank do loans?" it’s essential to understand the eligibility requirements and application process. Borrowers typically need to meet certain criteria, including a minimum credit score, a steady income, and a reasonable debt-to-income ratio.

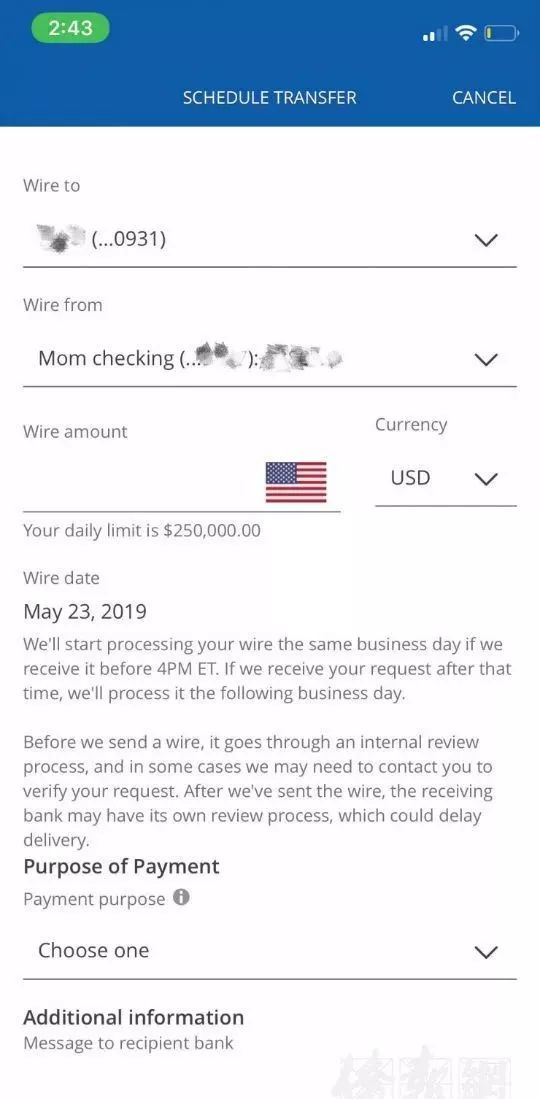

The application process is straightforward. Customers can apply online, via the Chase mobile app, or in person at a local branch. The online application is user-friendly, allowing applicants to provide their information quickly. After submitting the application, Chase will review the information and offer a decision, usually within a few business days.

Benefits of Choosing Chase Bank for Loans

There are several advantages to choosing Chase Bank for your loan needs:

1. **Reputation and Trust**: As a well-established financial institution, Chase Bank has a strong reputation for reliability and customer service.

2. **Competitive Rates**: Chase often offers competitive interest rates, making it an attractive option for borrowers looking to minimize their costs.

3. **Flexible Terms**: With a variety of loan products and terms, customers can find a loan that suits their financial situation.

4. **Online Banking Features**: Chase’s robust online banking platform allows borrowers to manage their loans easily, make payments, and track their finances.

In conclusion, if you’re wondering, "Do Chase Bank do loans?" the answer is clearly affirmative. With a wide range of loan options, competitive rates, and a solid reputation, Chase Bank is a viable choice for anyone in need of financing. Whether you’re looking to consolidate debt, buy a home, or purchase a vehicle, Chase has the resources and expertise to help you achieve your financial goals. Before committing to any loan, it’s always wise to compare offers from multiple lenders to ensure you’re getting the best deal possible.